|

China has been an important ceramic producer since the ancient times, and currently is the worlds’largest ce-ramic producer and exporter with significant contribution to the devel-opment of the global ceramic industry. In 2011 that just closed, China's ceramic industry continuously brought in ad-vanced technology, equipment and de-sign concepts from major ceramic pro-ducers in Europe while emphasizing in-dependent innovation. Remarkable re-sults have been achieved in utilization of new technology and R & D of products.

However, many unstable factors ac-companied China’s ceramic industry through 2011. Among other things, Chi-na’s national macro-control policies and the European anti-dumping sanction against China had major impact on the ceramic industry. The appreciating RMB and inflation further worsened the days of ceramic enterprises. Nevertheless, the majority of ceramic enterprises managed to maintain steady growth of both output and sales. In the whole, China’s ce-ramic industry sustained relatively stable development in 2011.

Ceramic Productivity

Continued to Rise

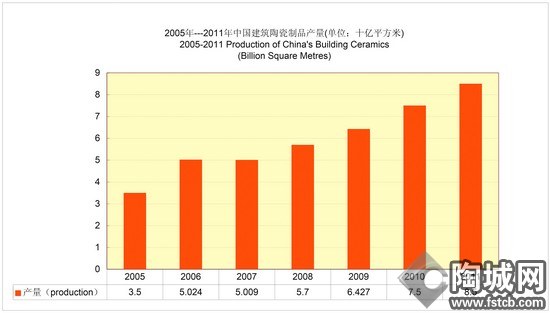

In recent years, ceramic production areas have sprung up all over China, and ceramic productivity has risen substan-tially. According to the latest data from relevant agency, there are 3,275 ceramic production lines in China, and the annual productivity will exceed 10 billion m2; the top three provinces in scale of lines are Guangdong, Shandong and Fujian. China will maintain its position as a ceramic power with the world's largest output, per capita consumption, as well as ex-port.

According to the data from the Na-tional Bureau of Statistics, by November 2011, the national output of ceramic tiles had reached 8 billion m2, up 14.9% year on year, and the sales had exceeded 300 billion Yuan, up 31% year on year; the export of ceramic tiles had exceeded 900 million m2, up 16% year on year. A total of 18.2 million pieces of sanitary ware had been produced, up 42.20% year on year, including 30.71 million m2 vitrified tiles, up 2.06% year on year. The national output of vitrified tiles had reached 260 million m2, up 22.10% year on year, in-cluding 210 million m2 produced by Fu-jian Province, up 37.68% year on year and accounting for 82.70% of the nation-al gross output.

In terms of sanitary ceramics, from January to November 2011, the national output of sanitary ceramic ware had reached 180 million pieces, up 17.17% year on year. Viewed from provincial and municipal outputs, in the first 11 months of 2011, the top three provinces in output of sanitary ceramics were Henan, Guangdong and Hebei, respectively ac-counting for 45.20%, 16.53% and 12.07% of the gross output.

Adverse Domestic and Over?鄄seas Conditions for Develop?鄄ment of Ceramic Industry

From the beginning of 2010, China’s real estate market underwent a series of policy control. Later policies on real estate became increasingly stringent: down payment proportions and rates of loans for second property were both raised, and loans for third or more prop-erty were halted…As upstream industry of real estate, the ceramic industry was also significantly impacted by real estate policies. In 2011, property transactions were dim across the country, and ce-ramic products were not in demand. Consequently, production was suspend-ed in major production areas, and enter-prises were seriously overstocked.

RMB exchange rate continued to rise in 2011, and the exchange rate of US dollar against RMB successively hit the new low of 6.6 and 6.5. The continuous appreciation of RMB casted great influ-ence on export, and the ceramic industry was also affected. In addition, the infla-tion and overheated economy brought about rising prices, resulting in rapid in-crease in raw material prices, fuel prices and transport costs.

In terms of international conditions, on 15 September 2011, EU officially pro-mulgated anti-dumping sanction against China, and the final award ruled that Chi-nese export to Europe was subject to a tariff of 26.3% to 69.7%, with only a few enterprises granted the lowest tariff of 26.3%; the majority of enterprises were to execute the intermediate tariff of 30.6%, and some were fixed at the high-est tariff of 69.7%. This amounted to “a life sentence”for most Chinese ceramic enterprises exporting to EU. Conse-quently China’s export of ceramic products to EU dramatically dropped in 2011. At the same time, anti-dumping against Chinese ceramics also started in countries in South America and East Asi-a, adding more hardship to the export of Chinese ceramic enterprises.

Ceramic Industry

Seeks Stable Growth in 2012

In 2011, under the influence of a number of factors, China’s ceramic in-dustry underwent some difficulties in its way forward. Nonetheless, in 2012 quite a few optimistic factors exist for the de-velopment of the industry. In 2011 the Ministry of Housing and Urban-Rural Development expanded the trial sites of the “Building materials going to villages”project, which had a positive influence on the development of extensive rural mar-kets of building materials; moreover, the ministry announced in December 2011 that indemnificatory apartments to be built in 2012 would be no less than the 5.9 million suites of 2011. These pieces of news are positive signals, predicting that China’s ceramic industry will con-tinue to steadily grow in 2012.

In 2012, China’s ceramic industry will progress while maintaining stability. The main trends include:

First, the optimization and upgrading of industrial structure will further pro-ceed, and improvements will be made in product quality, brand building, and af-ter-sale services. The industry will grow in stability;

Second, the state will strengthen regulation on industries with high con-sumption and pollution, and enterprises will make more efforts in environmental protection and utilization of new technol-ogy and equipment contributing to energy saving and emission reduction.

Third, in order to enhance industrial growth and product competitiveness, enterprises will continue to emphasize on innovation and R & D, and advanced technology and equipment such as inkjet technology will be widely used;

Fourth, influenced by fierce compe-tition, enterprises will make more efforts to explore and expand terminal channels, and new marketing modes such as e-commerce will emerge;

Fifth, under the influence of an-ti-dumping against China by EU, most enterprises will reduce export to EU markets and shift focus to emerging markets in the Middle East and Africa.